2025 Bio/Pharma Funding Trends: July’s Update

- Maryam Daneshpour

- Aug 8, 2025

- 3 min read

"Private bio/pharma funding remained low in July, remaining near June’s bottom.”

July 2025 marked the sixth consecutive month of muted bio/pharma funding activity, based on data from the BiopharmIQ database. While January saw a strong start to the year, funding has remained constrained since February, and July showed only a modest recovery from June’s low point. Activity across private deals, early-stage rounds, and public market sentiment reflects a sector still navigating capital headwinds.

This update highlights key metrics from July 2025 and provides a snapshot of how the current month fits into the broader trendline for the year.

Read our H1 2025 Bio/Pharma Funding Trends Report.

Funding Activity in July

Private bio/pharma companies raised $2.08 billion in July, slightly above the $1.93 billion recorded in June but still far below the $6.27 billion peak in January. July’s total also underperformed compared to July 2024, which saw $3.73 billion in private funding (FIG 1).

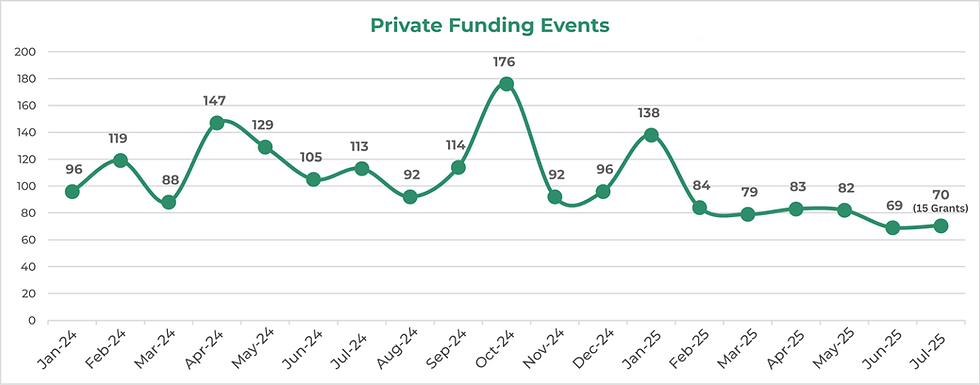

The number of private funding events in July remained relatively flat. A total of 70 funding events were recorded, a slight increase from June’s 69. Of these, 15 were grants, a number that we will track more closely in future months. Monthly deal counts have hovered around this level since April, with no clear signs of rebound (FIG 2).

Early-Stage Activity

Early-stage funding remained under pressure in July. Total capital raised in Seed and Series A rounds fell to $473 million, the lowest monthly total recorded since the beginning of 2024. This compares to $583 million in June and $2.03 billion in January (FIG 3).

There were 25 early-stage deals closed in July, up 25% from 20 in June. However, this remains well below the 60 deals recorded in January and well below the monthly median in 2024 (34). Early-stage investors appear to be continuing a cautious approach, similar to the overall trend for private investors, but it was good to see an uptick from June’s low (FIG 4).

Public Market Sentiment

In contrast to private market softness, public biotech indices saw mild upward momentum in July. The biopharma ETF XBI, which represents more small- and mid-cap biopharma stocks, rose from 83.08 at the beginning of the month to 85.66 by July 31. The IBB, which is weighted towards larger-cap biopharma, closed at 132.76, up from 127.63 at the start of the month.

This marks the second consecutive month of moderate public market gains, although both indices remain well below historical highs. While public sentiment appears to be stabilizing, it has not yet translated into a rebound in private deal activity.

Concluding Remarks: Where July Leaves Us

July’s bio/pharma funding environment remained quiet, though not inactive. The modest increase in private capital compared to June suggests a potential bottoming out, but overall activity remains far below 2024 levels. Early-stage funding continues to remain low, too, but a 25% uptick in the number of deals compared to June is a hopeful sign.

Despite headwinds, many companies succeeded in closing rounds, and public markets offered some signals of stability. Bio/Pharma is resilient.

Article History:

8/8/25 MV, MD

Not legal, investing, or tax advice.

I was diagnosed with Parkinson’s disease four years ago. For over two years, I relied on prescription medications and therapies, but unfortunately, the symptoms continued to worsen. My mobility declined, tremors increased, and I experienced growing fatigue and discomfort that affected my daily life. Last year, out of desperation and hope, I decided to try an herbal treatment program from NaturePath Herbal Clinic. Honestly, I was skeptical at first, but within a few months of starting the treatment, I began to notice real changes. My energy improved, the discomfort eased, and I felt stronger and more capable in my daily life. Incredibly, I also regained much of my stamina, balance, and confidence. It’s been a life-changing experience I feel more…